Copyright 2025 © | Mortgage Simple | All Rights Reserved | Privacy Policy | Web Services Provided by Panda Rose Consulting Studios, Inc.

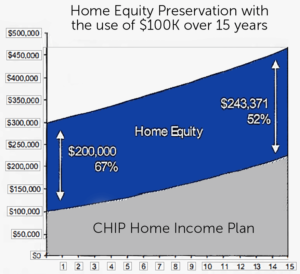

For homeowners aged 55 and older who would prefer to age in place. With CHIP Home Income Plan, you can unlock up to 50% of the equity in your home with no payments required until you choose to move or sell.

A CHIP Home Income Plan is a tax-free source of money to:

• Eliminate existing debt payments

• Enhance your retirement

• Cover the rising cost of home ownership

• Invest to create more income

With no regular payments required until you choose to move or sell.

Your reverse mortgage will NEVER exceed the value of your home.

CHIP Home Income Plan is provided by HomEquity Bank. We have been in business since 1986 and are the only national financial services company in Canada exclusively dedicated to providing financial solutions for seniors. We are recognized as the industry leader in home equity lending to seniors, with extensive market knowledge and experience.

Seniors today are living longer, saving less, spending more and carrying more debt. Unlocking your home equity is likely the most viable solution for you.

• Seniors are the fastest growing segment of the population¹

• 45% of Canadian in their 50s have less than $100K in retirement savings²

• 51% of pre-retirees expect to carry debt into retirement³

• 77% of senior homeowners’ net worth is locked up in home equity⁴

• 84% don’t want to move⁵

You are an ideal candidate if you are a homeowner aged 55 and older who:

• Needs more income

• Have little or no home-secured borrowing

• Have debt, but would prefer not to make monthly payments

• Don’t want to move from your home

¹Statistics Canada, 2011 ²Leger Marketing Study, 2012 ³HomEquity Bank Canadian Retirement Snapshot, 2011 ⁴Finances in the Golden Years, Statistics Canada ⁵Decima Research, 2005

• Available to homeowners aged 55 and older on their principal residence

• Location and type of home must qualify

• No income or credit qualifications

• Homeowners can access up to 50% of the home’s current appraised value based on homeowner’s age and that of their spouse, and on the location and type of home

• Funds are not taxed as income

• Funds can be received in a lump sum or over time. Most clients take a lump sum

• Any outstanding loans secured by the home must be retired with the CHIP Home Income Plan funds

• No regular payments are required

• Interest payment options are available (see Fact Sheet)

• The full amount only becomes due when the home is sold, or if both homeowners move out

• Clients have the option to repay the principal and interest in full at any time

• An early payment charge may apply depending on when you repay. These may be waived or reduced in the event of death or a move to a long-term care facility or retirement residence

• Title remains in the clients’ name and they will never be asked to move or sell to repay their Home Income Plan

• Clients are responsible for up-to-date payment of property taxes, fire insurance and condominium/maintenance fees, and maintenance of the property

• Clients may choose between a variety of interest rates and terms

• Interest is added to the outstanding balance

• Interest rate discounts that significantly lower the cost of borrowing are available

• Set-up costs include a home appraisal, independent legal advice and legal & closing costs

• In over 25 years of our experience, over 99% of homeowners have equity remaining upon repayment

• The amount to be repaid is guaranteed not to exceed the fair market value of the home at the time it is sold, protecting the homeowner or the estate

You don’t have to be a financial expert to understand what’s going on here. When banks in the United States fail, investors start to get

I often get asked, “How can I improve my credit score?” well there are two most effective ways you can improve your credit. Paying your

As a mortgage broker I serve all of Canada. I specialize in spousal buyout programs (divorce mortgages) and can make the process as efficient and stress free as possible. I look forward to chatting with you about your mortgage needs. I can help make mortgages simple.

INDI Head Office: 223 14 Street NW, Calgary, AB T2N 1Z6 | [email protected] | 800.517.8670

COMPLIANCE OFFICER: Gord Appel (403) 714-4663

BROKER OF RECORD: Gord Ross 800.517.8670 ext 301 | [email protected]

Licensed in Alberta and Ontario #M24000161 Level 2

Copyright 2025 © | Mortgage Simple | All Rights Reserved | Privacy Policy | Web Services Provided by Panda Rose Consulting Studios, Inc.