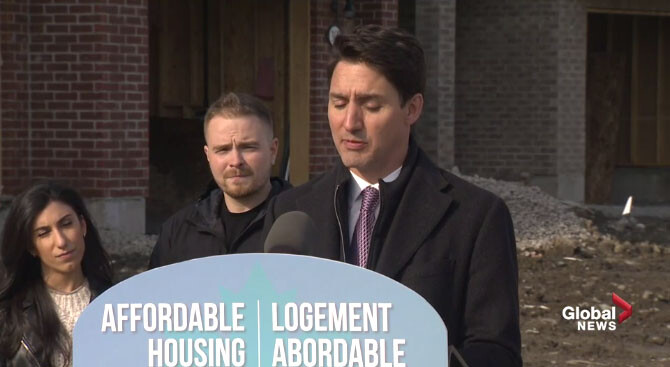

The Federal Budget announced new mortgage rules that were not what we were hoping for.

The best part of the new rules allows Canadians to withdraw $35K from their RRSP which is an addition of $10K over the previous $25K. This is awesome for the first time home buyers program – but remember the RRSP’s still need to repaid over time or they become taxable income.

The second portion that was supposed to be relief is confusing to consumers and disappointing. CMHC will now allow a purchaser up to 10% funding for new homes and 5% for existing homes with a household income of up to $120K. A home buyer purchasing a $400,000 home with five per cent down and a five per cent CMHC shared equity mortgage (worth $20,000), would see their mortgage reduced from $380,000 to $360,000, lowering their monthly mortgage bill. Buyers may borrow no more than four times their annual household income. This additional $20K will have to be repaid to CMHC but terms have not yet be laid out. This new program is set to commence in the fall of 2019. In my opinion this does little in our local economy and encourages Canadians to take on more debt…which is not something we need.

We were hoping for a adjustment to the stress test or bringing back 30 year amortization…the silver lining is the feds mentioned that the stress test will continue to be reviewed and we may see changes at a later point in time. Lets keep our figures crossed.

Watch the video snippet of the announcements below:

Questions on your mortgage, or want to compare your mortgage to what is currently available? Please email me.

![]()